CarPlay and Android Auto offer exciting potential for restaurant mobile apps

The top 10 fast food apps in the US last month were downloaded just 2.2% less than the month before. With 8.83 million new installs between them, this is the second highest month for the top 10 since we started tracking in May this year. This month we’ll look at the successes Dunkin’ and Chipotle have seen from their investment in mobile, but first we’ll break down this month’s rankings.

The 2.2% drop was mainly due to McDonald’s seeing its monthly downloads drop by 200,000. water finding its level. August saw the highest number of monthly downloads for the McDonald’s app since October 2018, when it launched. Fool. To treat. To earn! game that required the app to fully participate.

Taco Bell and Dunkin’ traded places, with Dunkin’ improving and taking fourth place. Chipotle climbed five spots to secure a spot on the leaderboard at No. 9 while Sonic brought the boot down to No. 14. Wendy’s also dropped the leaderboard, dropping to No. 13. Subway moved up one spot as well as Burger King in the No. 10 plaza.

Despite only moving up two spots on our top chart, Dunkin’ saw the biggest increase in absolute downloads, with almost 100,000 more in October than in September. The Dunkin’ mobile app has been gaining since August, however, when it was announcement the app was available through Apple CarPlay. Apptopia’s X-Ray dataset says it’s the only fast serve app in the US with this integration.

CarPlay and Android Auto are big opportunities for fast food mobile apps. Apptopia data indicates that usage of car market apps (Carfax, Carvana), parking apps (ParkMobile, SpotHero) and car rental apps (Hertz, Turo) are all above 2019 levels, since the beginning of the year. The pandemic has stimulated this (potentially temporary) distancing from public transport. As the demand for vehicles has increased and we are spending more time in cars, the use case for a quick service app that is securely available in the car is seemingly obvious. Who wouldn’t want to order their usual coffee and breakfast sandwich with ease on the way to work?

Looking at iOS estimates of user sessions comparing Dunkin’ to other major coffee chains, we see Dunkin’s app jump from below the market average to open an 18.5% gap above, once CarPlay has become available.

Speaking of coffee channels, they account for some of October’s biggest growth figures for month-over-month downloads. Tim Horton’s increased new mobile app installs by 54%, Krispy Kreme gained 23% more new app users, KFC increased downloads by 19%, and Peet’s Coffee increased downloads by 17.5 %. The market average (the top 36 quick-serve apps in the US) only increased by 0.07%.

Tim Horton’s growth seems to come from a combination of its National Coffee Month Campaignwhich is only available for in-app/online purchases, and its Smile Cookie charity campaign.

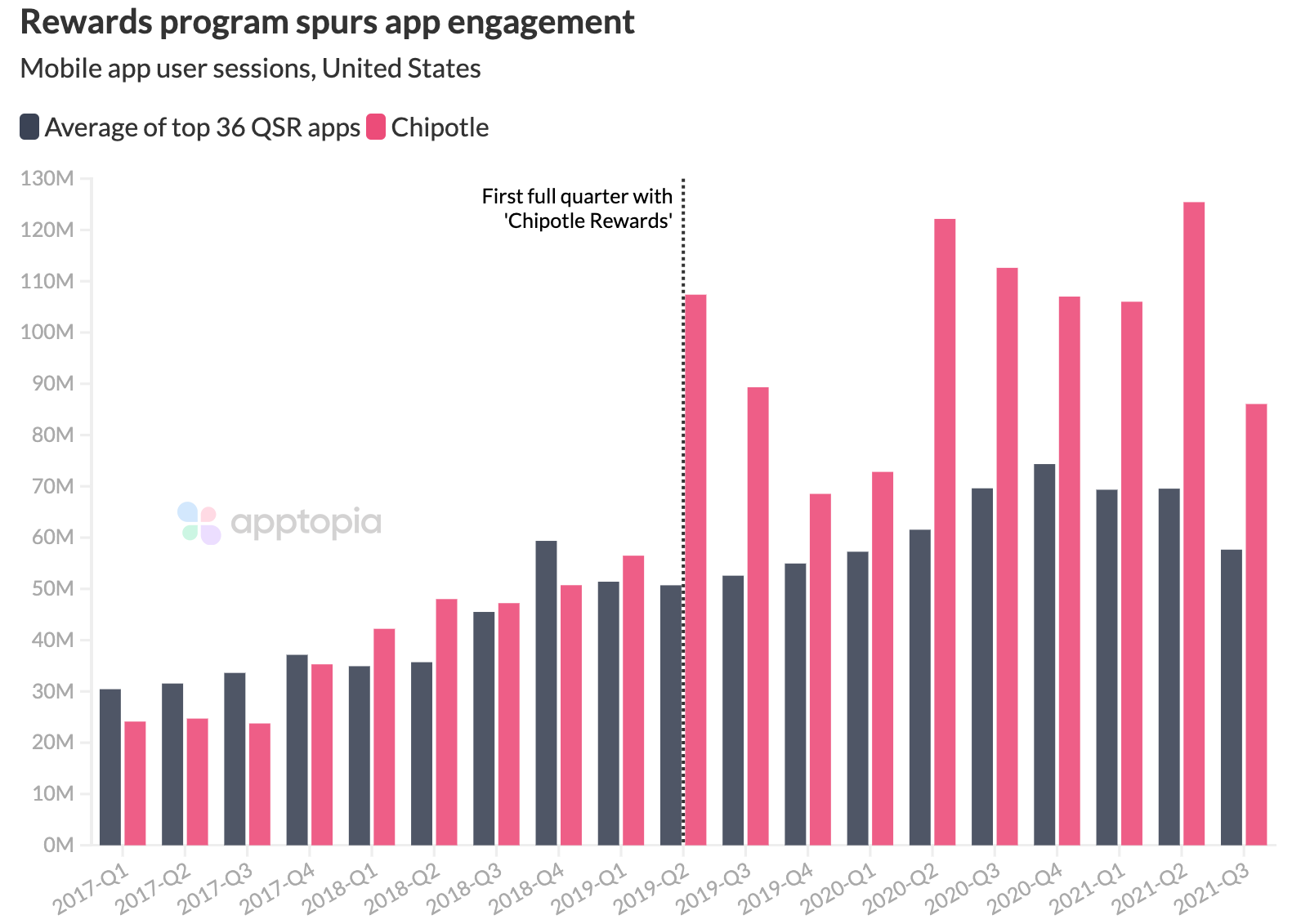

While Chipotle wasn’t this month’s biggest gainer in terms of absolute downloads, it moved the most spots in the rankings, rising five spots to #9 on our top chart. This app has been able to have consistently high user sessions compared to its peers due to its well-managed loyalty program.

Since introducing its program, Chipotle has had one of the best fast food apps from an engagement perspective. Why? Because the team there understands that a loyalty and rewards program is a living thing. He is not a “set it and forget it” program like before. When the market became saturated with loyalty programs, it became necessary to keep fueling the fire with new, interesting, entertaining and innovative campaigns. For example, the Q2 2021 pop you see in the chart above came from the creation of a retro racing video game where loyalty members competed for prizes, including a brand new Tesla.

Adam Blacker is the Vice President of Insights at Apptopia, the leader in real-time competitive intelligence. Brands use the platform to generate insights into mobile apps and connected devices. They rely on Apptopia to better understand consumer behavior and intent on app-based devices to gain competitive advantage.